Wage after tax

Also known as Net Income. This marginal tax rate means that your immediate additional income will be taxed at this rate.

As A Percentage Of The U S Economy Wages Keep Dropping With Increasing Productivity As Corporate Profits Rise Chart Corporate Profit

The sum of all taxes and contributions that will be.

. Median household income in 2020 was 67340. If you filed jointly youll be given a 100 rebate 50 per person. The money you take home after all taxes and contributions have been deducted.

Federal income tax rates range from 10 up to a top marginal rate of 37. That means that your net pay will be 43324 per year or 3610 per month. If this income was not included in the final.

The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. Your average tax rate is 270 and your marginal tax rate is 353. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month.

In addition to income tax there are additional levies such as Medicare. For instance it is the form of income required on. Ad Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022.

This marginal tax rate means that your immediate additional income will be taxed at this rate. The latter has a wage base limit of 147000 which means that after employees earn that much the tax is no longer deducted from their earnings for the rest of the year. Free tax code calculator.

For instance an increase of. This places Ireland on the 8th place in the International. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

In Ontario and Alberta thats 15 an hour 600 a week 2600 a. Ad See the Paycheck Tools your competitors are already using - Start Now. See where that hard-earned money goes - Federal Income Tax Social Security and.

Is a gradual tax that has four brackets. Free Online Tax Tutorial - Tax Consultant Certification - Be Certified Tax Consultant 100. KiwiSaver knumber optional The percentage you contribute.

The income tax in New Zealand starts at 105 for incomes up to 14000 NZD and ends at 39 for wages greater than 180000 NZD. 14 rows After Tax. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Your average tax rate is 270 and your marginal tax rate is 353. After-Tax Income In the US the concept of personal income or salary usually references the before-tax amount called gross pay. What is the average salary in the US.

On the high end of the minimum wage British Columbia pays 1565 an hour 626 a week 2713 a month and 32552 a year. Tax bracket start at 0 known as the tax-free rate and increases progressively up to 45 for incomes over 180000. Anyone who filed taxes as a single person will receive 50.

For instance an increase of. Reduce tax if you wearwore a uniform. If your salary is 40000 then after tax and national insurance you will be.

Transfer unused allowance to your spouse. Income qnumber required This is required for the link to work. Try out the take-home calculator choose the 202223 tax year and see how it affects.

If you make 55000 a year living in the region of New York USA. If you make 55000 a year living in the region of California USA you will be taxed 11676. Find out how much your salary is after tax Withholding.

IRD is income that would have been included in the deceaseds tax returns had they not passed away. But thanks to various tax benefits the lions share of earnings about 75 still. Read reviews on the premier Paycheck Tools in the industry.

Check your tax code - you may be owed 1000s. It can be any hourly weekly or annual before tax income. States dont impose their own income tax for.

This places US on the 4th place out of 72 countries in the. 1 day agoAn executor of an estate. Individual Income Tax Rebate.

For example the income tax rate for persons with an annual salary of more than 685 thousand euros is 4950.

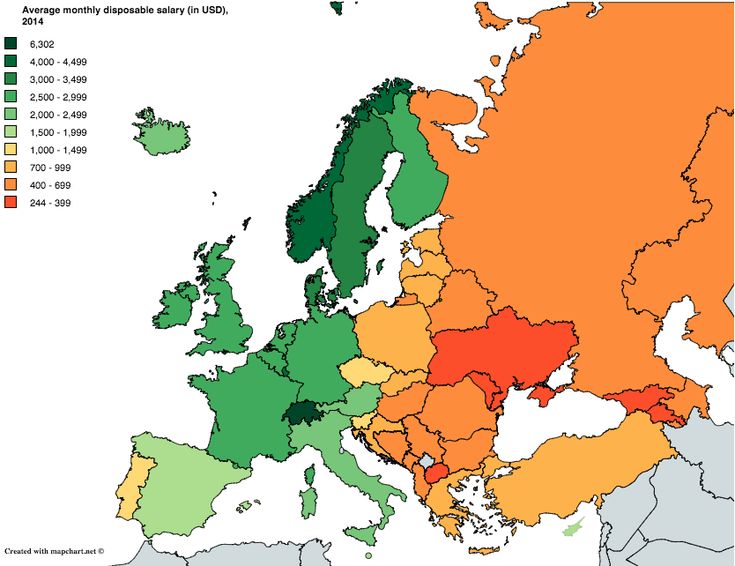

Amazing Maps On Twitter Amazing Maps Europe Map Map

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

European Countries By Total Burden On Labor Vivid Maps European Map Map Europe Map

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractor Bookkeeping Business Small Business Accounting Small Business Bookkeeping

Here S How Much Income Is Taxed Around The World Income Tax Income Information Graphics

Income Tax Calculator Colorado Salary After Taxes Income Tax Payroll Taxes Federal Income Tax

Income Tax You Will Pay On The Average Wage

Why Am I Paying Taxes On My Wages Then Paying Sales Taxes To Spend My Money Then Paying Income Taxes On Money They Already Taxed And Paying Property Taxes Af Taxes

Largest Historical Gap Of Profits To Employees Declines In Wage Boosted Profit Margins Profit Wage Gap Positive Economics Profit Global Economy

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Manage Your Money Net Income Credit Card Debt Relief Income

Pin On Saving Money Budget

Taxing Wages Data Visualization Powerpoint Word Economy

Top Tax Rate On Personal Income Would Be Highest In Oecd Under New Build Back Better Framework Income Tax Rate Income Tax

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

Which Countries Pay The Most Income Tax Infographic Salario Impuesto Trabajar En El Extranjero

How To Sell Online Payslips To Your Employees Payroll Payroll Template Things To Sell